Four Trends ETF Marketers Should Watch in 2024

To survive in the scrappy ETF world, you need sharp elbows.

The ETF business is highly competitive whether you’re one of the 800-pound gorillas or an upstart firm with a more specialized product lineup. For the incumbents, it’s a constant challenge to keep up in the marketing and brand awareness arms race as well as defend against smaller, more agile players. The disruptors, on the other hand, need to differentiate themselves in a very crowded field where the big firms use their scale to brutal advantage.

Here are four trends that all ETF marketers should watch in 2024 to stay ahead of the curve:

1 – Spot Bitcoin and digital assets ETFs

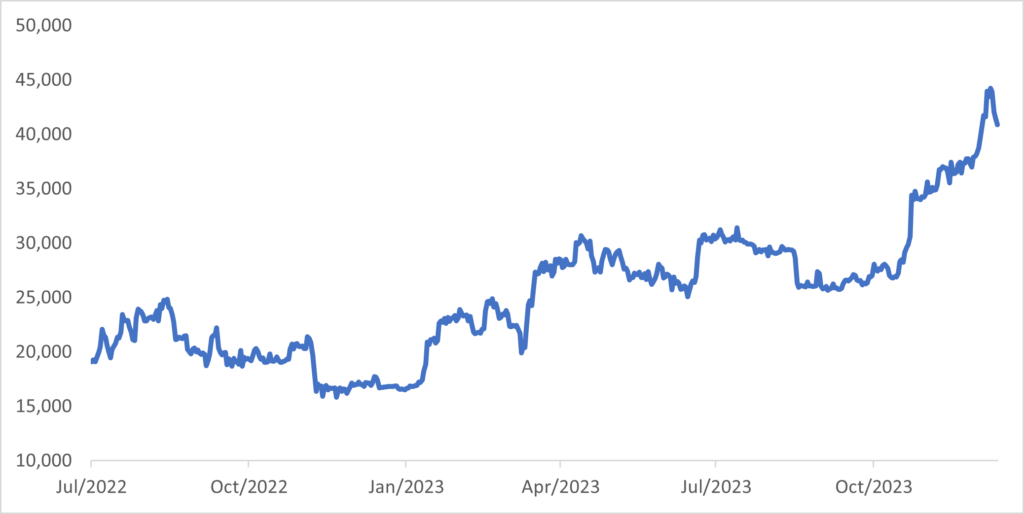

Although regulators have yet to approve the first spot bitcoin ETF, industry experts believe it could happen in early 2024, CNBC.com reports.

There are already ETFs that provide exposure to bitcoin futures or invest in the shares of companies involved in the cryptocurrency universe. Spot bitcoin ETFs are a game-changer, though, because they would provide exposure to the actual cryptocurrency. They could also open the floodgates for more ETFs that hold other cryptocurrencies and digital assets.

Bitcoin prices have been rising on anticipation of a spot bitcoin ETF

Source: Nasdaq.com, as of 12/13/2023.

Many investors and advisors have been waiting for a spot bitcoin ETF to get direct exposure in the convenient and familiar ETF wrapper. Some industry analysts estimate that spot bitcoin ETFs could generate billions of dollars of inflows in relatively short order.

Marketing will play a big role for spot bitcoin ETF providers, particularly if regulators allow several to launch simultaneously. Smaller players will need to differentiate themselves from big firms and their well-known brands, bigger marketing machines, and distribution armies. More established firms, meanwhile, can emphasize how their size and investment expertise are valuable in the fragmented and less regulated crypto market.

Some cryptocurrency ETF pioneers plan to steer clear of spot bitcoin ETFs altogether because they fear high marketing and regulatory costs could make them unprofitable to manage, Reuters reports. It’s a lesson that ROI should always be a top consideration for all firms when determining where and when to spend those precious marketing resources.

2 – Will the real active ETFs please stand up?

Actively managed ETFs are still much smaller than their passive peers, but active inflows have picked up lately. U.S.-listed active ETFs have taken in nearly $120 billion so far in 2023 through November, which would easily break last year’s record, according to Morningstar.

Yet the flows to active ETFs may not be as impressive once you dig into the data a bit. That’s because much of the buying of “actively managed” ETFs has been concentrated in funds that don’t use traditional active approaches such as picking stocks and bonds. Instead, some of the most popular active ETFs use quantitative options-based strategies or tilt to specific factors like value and dividends.

“You don’t find a lot of active managers taking a lot of active bets,” Deborah Fuhr, ETFGI co-founder, told Bloomberg. “It’s not fundamental active, like doing a lot of homework on the stocks and deciding what to buy. It’s more systematic.”

This dynamic creates several key takeaways for ETF marketers. First, sophisticated ETFs, like those that invest in options or seek defined outcomes, require high-quality educational content to explain how they work and how they can be used in portfolios. The second takeaway is that traditional actively managed ETFs have yet to fully gain traction. Managers of these ETFs, which include traditional asset managers that oversee mutual funds, should focus on clearly explaining the value proposition of their active philosophy and why ETFs are a tax-efficient wrapper for those strategies.

3 – Here come the bond ETFs

Life in bond ETFs has been anything but staid lately. Rising interest rates have led to losses in fixed-income ETFs, but the category has still experienced solid demand in 2023. The buying in bond ETFs appears to be driven by bargain hunters and investors looking for low-cost ways to get exposure, Reuters reported.

In any case, it makes sense that investors are interested in bond ETFs to capture higher yields and help navigate an uncertain interest rate environment. Through November, bond ETFs have gathered flows of $184 billion in 2023 for a 14.3% organic growth rate, compared with 5.6% for stock ETFs, according to Morningstar.

The challenge for marketers is educating investors and advisors on how bond ETFs work when most of their experience may be with equity-based ETFs. In particular, some investors want to know about the liquidity of bond ETFs and any tax wrinkles. Many fixed-income investors will also be interested in which bond ETFs to use to position for interest rates moving in either direction in 2024.

4 – Giving hedge funds a run for their money

An emerging trend to watch in 2024 and beyond is the growth of ETFs that seek to deliver hedge fund-like strategies in a tradable, liquid vehicle. Simplify is a good example of an innovative ETF provider that offers strategies for absolute return, tail hedging, and more with options-based ETFs. Simplify has even managed to land some institutional ETF clients that historically would use hedge funds, Bloomberg Intelligence reports.

Investors have many choices when they’re looking for long/short equity ETFs that use sophisticated option-based approaches. Goldman Sachs manages an ETF that uses artificial intelligence (AI) to scan 13F filings to identify stocks that are popular with hedge funds.

These institutional-caliber ETFs are another example of a category that requires extra love from marketers in terms of crafting educational materials and messaging that resonate with advisors and investors.

We can help raise your ETF content marketing game

We are content partners with leading firms across the ETF industry, including asset managers representing more than $1.5 trillion in ETF assets. Our clients include several of the largest ETF providers, boutique firms offering cutting-edge strategies, and index providers. Learn more about our marketing services for ETF and index providers.

If you would like to chat about how to apply these ETF trends to your marketing strategy, please contact us.

About the Author John Spence leads the ETF content marketing practice at Wentworth Financial Communications. He collaborates with a team of writers and editors at Wentworth to help professionals across the financial services industry build their brands by creating investment-grade infographics, videos, email campaigns, blog posts, social media content, white papers, bylined articles, newsletters, and other forms of content marketing.

About the Author John Spence leads the ETF content marketing practice at Wentworth Financial Communications. He collaborates with a team of writers and editors at Wentworth to help professionals across the financial services industry build their brands by creating investment-grade infographics, videos, email campaigns, blog posts, social media content, white papers, bylined articles, newsletters, and other forms of content marketing.