The $9 Trillion Opportunity for Asset Managers

It’s no secret that profits at asset managers are being pressured by the inexorable trend lower in fees. There’s one opportunity, though, that industry experts say has asset managers salivating: the nearly $9 trillion of cash on the sidelines.

For the industry, “this is a huge challenge but also a huge opportunity to mobilize these cash positions,” said Ashley Wood, managing director at ISS Market Intelligence. Wood shared these and other insights on the trends shaping the asset management industry at a recent Investment Management Education Alliance (IMEA) 2024 outlook webinar.

For asset managers looking to attract some of this cash hoard back into markets, investor education and thought leadership to build brand awareness can help in an increasingly crowded marketplace. Advisors are looking for content that helps them solve immediate client challenges, and content that explains why and how to deploy cash in today’s market is a huge opportunity for asset managers to build brand awareness and affinity with advisors.

‘A risk-off profile’

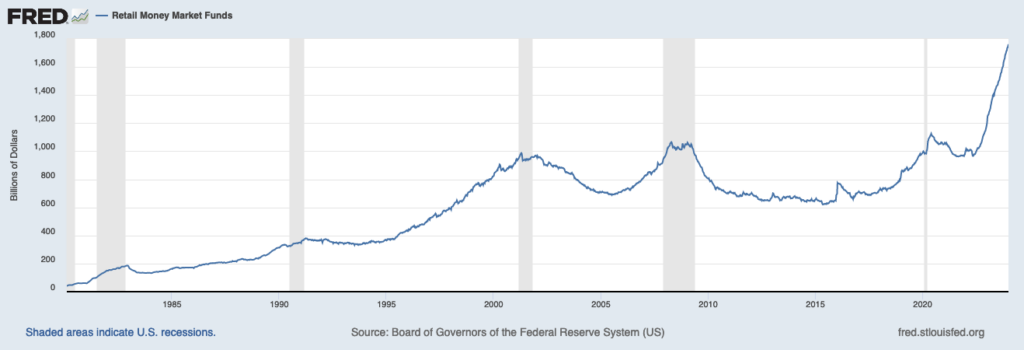

Rising interest rates are a big reason why investors have piled into money markets and cash-like investments after years of rock-bottom yields.

There was about $8.8 trillion sitting in money funds and CDs as of the third quarter of 2023, The Wall Street Journal reported. Meanwhile, assets in money market funds have surpassed $6 trillion for the first time ever.

Retail investors have piled into money market funds

Source: Federal Reserve Bank of St. Louis (FRED), retail money market fund assets only, data as of 1/1/2024.

Wood at ISS said about 15% of U.S. households’ investable assets were sitting in liquid, short-term vehicles, such as CDs and money funds as of September 2023.

“We’ve seen a significant shift toward a risk-off profile playing out through COVID and since,” said Wood, adding that aging investor demographics are also driving assets to cash-like vehicles.

Still, there’s an opportunity for asset managers if at least some of this cash starts coming back into the market, especially if interest rates move lower again.

Getting cash off the sidelines…and into your net flows

In the current landscape, Wood suggested that asset managers should ask themselves some key questions:

- How do you educate and get advisors comfortable with a compelling message for clients about taking on more risk in today’s market environment?

- Are you set up for the future when this cash starts to mobilize and come back in? In other words, are you built for the future and where flows are headed?

In terms of marketing tactics, this means asset managers should be laser-focused on communicating with advisors in their preferred formats with content that adds value.

Since COVID, advisors prefer more of a mix of asset manager touchpoints across different mediums. Emails, virtual meetings, webinars, thought leadership, and other forms of digital communication have replaced in-person meetings in many cases.

Helping advisors communicate with clients about getting out of cash is an opportunity for asset managers to build brand awareness with intermediaries. It’s also a chance for asset managers to illustrate the value proposition of their funds that can address a timely challenge for advisors.

In fact, the majority of advisors (58% according to ISS) believe a strong brand is important when recommending an asset manager’s products to clients.

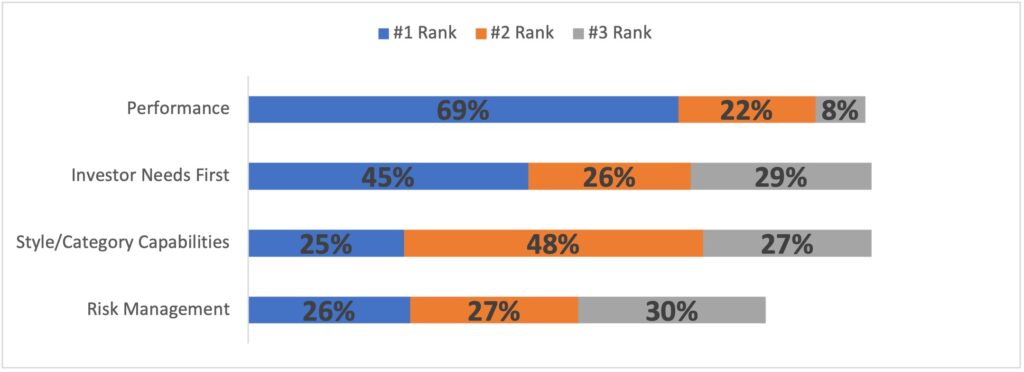

While performance will always be table stakes when advisors evaluate asset managers, there are other important factors at work.

Advisors: When thinking about the asset managers that you trust to manage your clients’ money, which three factors are most important?

Source: ISS Market Intelligence.

Advisors don’t want product pushes. Instead, they want to know how an asset manager’s lineup is differentiated from competitors and how its strategies can solve a need today, such as getting nervous cash off the sidelines. Advisors with an eye on market volatility are also interested in firms’ risk management processes to help protect client capital.

Indeed, the importance of being investor-centric connected to most of the themes Wood focused on throughout the IMEA webinar. Even asset managers who are selling to advisors should remember that the advisors’ clients are the end users of their products.

How asset managers can improve brand perception

Wood said there are some strategies asset managers can use to boost brand awareness to attract potential cash coming off the sidelines, according to ISS research.

Asset managers need to be intentional about how they define their unique value proposition in these areas discussed above:

- Investor-centric

- Differentiated capabilities

- Risk management

In terms of delivering those messages, asset managers should be consistent on where their expertise is, rather than simply focusing on what’s hot now.

Wood added that content and thought leadership can move the needle for an asset manager’s brand perception, especially within the RIA segment.

Outside of a direct touchpoint with a field wholesaler, advisors consider thought leadership to be the next most effective way for an asset manager to convey brand, Wood explained. And client-approved content is key.

Education from asset managers on timely topics such as sidelines cash, alternative investments, active ETFs, and direct indexing can help advisors differentiate themselves.

Asset managers should focus on how to become “an indispensable partner to financial advisors in a heavily competitive business,” Wood concluded.

About the Author John Spence leads the ETF content marketing practice at Wentworth Financial Communications. He collaborates with a team of writers and editors at Wentworth to help professionals across the financial services industry build their brands by creating investment-grade infographics, videos, email campaigns, blog posts, social media content, white papers, bylined articles, newsletters, and other forms of content marketing.

About the Author John Spence leads the ETF content marketing practice at Wentworth Financial Communications. He collaborates with a team of writers and editors at Wentworth to help professionals across the financial services industry build their brands by creating investment-grade infographics, videos, email campaigns, blog posts, social media content, white papers, bylined articles, newsletters, and other forms of content marketing.