‘Old School’ Active ETFs are Changing the Narrative: What Marketers Need to Know

The rise of actively managed ETFs was one of the themes we flagged for ETF marketers to watch in 2024. About halfway through the year, one subplot that has emerged is the growth of active ETFs that employ classic stock picking.

We’re talking about highly concentrated active ETFs that pride themselves on their high active share and go to great lengths to separate themselves from active ETFs with exposures that look more like the S&P 500 than a carefully curated portfolio of high-conviction stocks.

We also noted that, while active ETFs are growing quickly, the data can be a bit misleading on the surface. That’s because most of the assets in active ETFs reside in funds that are more quantitative or use option overlays.

Now, though, we’re seeing more “old school” active ETFs, often captained by well-known portfolio managers who have built impressive track records in other vehicles like mutual funds, hedge funds, and institutional SMAs.

From a marketing perspective, these classic active ETFs clearly have different opportunities for storytelling than more passive and quant-based ETFs that track an index. Telling this active story, however, also presents new challenges for content marketers.

A preference for active strategies in ETF form

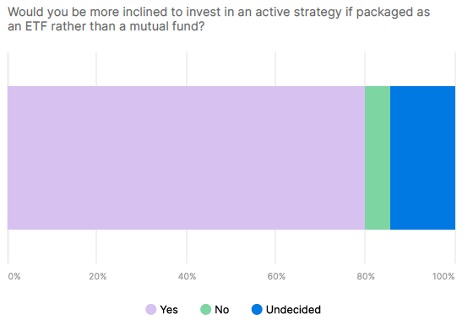

The opportunities for active ETF providers are vast. According to the Trackinsight Global ETF Survey 2024, a significant majority (80.1%) of respondents—which included family offices, advisors, and asset managers—would prefer an active strategy in an ETF over a mutual fund, showing a strong preference for the ETF structure.

80% of investors favor active ETFs over mutual funds

Source: Trackinsight Global ETF Survey 2024.

‘Matching great managers with a great vehicle’

We’re seeing more firms launch active ETFs that are managed by teams that have built up stellar track records in mutual funds and other product structures.

BlackRock, the parent company of iShares, is the biggest ETF provider but is still relatively new in active ETFs. Jay Jacobs, U.S. Head of Thematic and Active ETFs at BlackRock, spoke about the firm’s active ETF push in a recent Bloomberg appearance.

“It’s really about taking our world-class managers and bringing them into the structure that is increasingly the vehicle of choice, particularly amongst advisors and RIAs,” Jacobs said in the Bloomberg interview. “So this is just about matching great managers with a great vehicle.”

The recent launch of BlackRock Long-Term U.S. Equity ETF (BELT) is a case in point. One of BELT’s portfolio managers, Alister Hibbert, co-manages one of BlackRock’s largest hedge funds. In bonds, BlackRock Flexible Income ETF (BINC) is an active ETF co-managed by another star manager, Rick Rieder. These funds are designed to be nimble and investors should probably expect their performance to stray far from popular benchmarks.

In general, one marketing challenge is the inability to draw a bright line between the new ETF and the outperformance of the existing strategy, whether it’s a hedge fund or SMA.

Marketers must also keep in mind that, to align with FINRA guidelines, any comparison or reference to the performance of a previous fund or strategy must include clear disclaimers that the performance pertains to a different investment product. Materials should also include other differences between the ETF and the older strategy, such as investment approach and fees. Complying with these rules can be clunky at times, but there are ways to thread the needle in a way that showcases the expertise and investment philosophy that the management team is bringing to the ETF.

‘Differentiated alpha’

Although the active vs. passive debate gets a lot of airtime, the reality is that investors, advisors, and institutions often use a mix of active and passive ETFs in the same portfolio.

BlackRock’s Jacobs said investors may purchase a passive ETF for their core U.S. equity exposure and use a “barbell” strategy to complement it with something like BELT that can generate alpha on the side.

More model portfolio providers are including active ETFs, which can be a powerful driver of future growth. With active ETFs, investors and model managers typically look for “differentiated alpha” and managers with an edge in their markets, Jacobs said. BELT is a prime example because it’s a high-conviction, concentrated strategy based on fundamental research and stock picking.

Marketing active ETFs is different from passive ETFs, which are generally all about cost, size, and liquidity. Fees are certainly important when comes to active ETFs, but advisors and gatekeepers are also looking for strategies that offer distinct exposures. It’s imperative for active ETF marketers to focus on elements of the management team’s approach that allow it to generate differentiated sources of alpha.

This is where a “show don’t tell” approach is vital. Rather than simply explaining the team’s approach to stock selection and portfolio construction, content should provide specific, vivid examples of where this thinking led to high-conviction decision-making and unique exposures that distinguish the fund from active ETFs that end up staying very close to the index.

Key marketing takeaways for active ETF managers

The demand for active ETFs presents managers with real opportunies, but not without challenges. Navigating the compliance restrictions about manager track records while articulating the fund’s approach to generating differentiated alpha are among the top priorities for marketing active ETFs. To help active ETF marketers achieve their objectives, we’ve identified some marketing best practices:

- Know your audience: If a firm chooses to market an active ETF to an intermediary audience, it should recognize that advisors process information differently than institutional clients and tailor the message accordingly. Because advisors tend to have shorter attention spans, content needs to be digestible and clearly explain how the ETF can be used in client portfolios before featuring the the bells and whistles. Infographics can be a particularly useful tool on this front. Providing advisors with one- or two-page visually driven documents can make it easy for them to convey how the ETF’s defining characteristics and approach to alpha generation fit into the client’s portfolio.

- Use a mix of mediums: No one piece of content will be a silver bullet for telling an active ETF’s story to advisors and end investors. Marketers should use a variety of content types and understand the strengths of each one. For example, videos can be highly effective for showcasing a high-profile management team. Q&As can be useful for addressing common misconceptions about the asset class or strategy. Webinars (especially if they’re approved for CE credit) can be powerful venues for advisors who want to take a deeper dive into the nuances of the fund or asset class. As mentioned above, infographics are particually good at zeroing in on the benefits an ETF brings to a client portfolio.

- Create client-ready content: Advisors want materials that are approved for public use so they can easily share them with their clients and make the case for a particular active ETF. This means marketing teams must get the content approved for public use, which is a much tighter compliance standard than for financial professional use only. For example, public-use content needs to define terms, such as interest rate risk and smart beta, that industry professionals take for granted. This can add a lot of disclosure copy to a marketing piece, so teams need to plan accordingly when it comes to how they phrase certain language and lay out marketing materials.

We can help boost ETF content marketing

Wentworth Financial Communications develops content for leading firms across the ETF industry, including asset managers representing more than $1.5 trillion in ETF assets. Our clients include several of the largest ETF providers, boutique firms offering cutting-edge strategies, and index providers. Learn more about our marketing services for ETF and index providers.

If you would like to chat about how to apply these ETF trends to your marketing strategy, please contact us.

About the Author John Spence leads the ETF content marketing practice at Wentworth Financial Communications. He collaborates with a team of writers and editors at Wentworth to help professionals across the financial services industry build their brands by creating investment-grade infographics, videos, email campaigns, blog posts, social media content, white papers, bylined articles, newsletters, and other forms of content marketing.

About the Author John Spence leads the ETF content marketing practice at Wentworth Financial Communications. He collaborates with a team of writers and editors at Wentworth to help professionals across the financial services industry build their brands by creating investment-grade infographics, videos, email campaigns, blog posts, social media content, white papers, bylined articles, newsletters, and other forms of content marketing.