From Data to Differentiation: Content Marketing Strategy for Index Providers

With trillions of dollars tracking benchmarks through ETFs and derivatives, index providers like S&P Dow Jones, MSCI, and FTSE Russell play a critical role in modern financial markets. But for these firms, success goes beyond providing benchmarks and data—it’s about strategically positioning themselves in a competitive market.

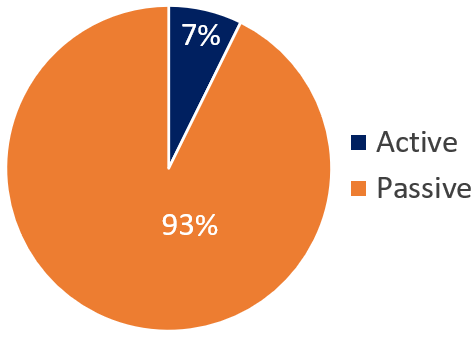

ETF assets recently crossed the $10 trillion milestone, a timely reminder of the power of index providers that oversee iconic benchmarks like the S&P 500 and Russell 2000. Although actively managed ETFs have been grabbing attention lately, the bulk of ETF assets reside in passively managed ETFs that track benchmarks.

Active vs. passive in ETF assets

Source: Global ETF Flows Q3 2024, Morningstar.

As the space becomes more crowded, index providers must differentiate themselves through compelling marketing strategies that demonstrate their unique value propositions to ETF issuers, advisors, institutions, and other stakeholders.

For index providers, the opportunity lies in translating this massive growth into a competitive advantage through marketing that not only explains their benchmarks but builds trust, communicates innovation, and demonstrates thought leadership.

Marketing insights for index providers in a crowded field

For index providers, success now hinges on much more than simply creating benchmarks and providing data. In a saturated market, standing out requires marketing that displays more than just technical excellence—it demands strategic, targeted content that speaks directly to the pain points of decision-makers across the investment ecosystem.

To stand out, index providers need to shift from being data suppliers to becoming strategic marketing leaders in their space. They must move beyond technical data and actively shape investment narratives that resonate with specific audiences. Whether creating custom indexes for ESG integration, thematic strategies, or multi-asset portfolios, strategic content marketing will be the difference between staying relevant and being lost in a competitive marketplace.

Marketing teams should focus on creating content strategies that go beyond simply describing product features to address key questions that the ETF ecosystem—including asset managers, advisors, and exchanges—regularly face. For example, what are the unique benefits of your index in managing risk, or how does your benchmark better align with a specific investment trend, such as ESG or artificial intelligence? By answering these questions, debunking common misconceptions, and addressing specific pain points, index providers can position themselves as indispensable partners in the investment process.

In addition, using content formats such as white papers, infographics, and case studies is especially effective in showcasing thought leadership. These formats allow index providers to demonstrate not only their technical expertise but also their ability to solve real-world problems for their clients.

Communicating your value proposition as an index provider

While the sheer size of the passive market is exciting, it also means that differentiating from competitors in the same space is increasingly difficult. This is where marketing comes into play. To cut through the noise, index providers must craft a unique narrative around their value proposition that resonates with ETF providers, advisors, and institutional investors.

Whether through content that highlights lower tracking error, better sector diversification, or specialized indexes for niche strategies, the key is to position your benchmarks as a solution to the specific needs of your audience. Custom indexes, for example, can be tailored for institutional investors or advisors looking to build model portfolios, and this ability to customize should be a focal point of your marketing message.

Tactical recommendations for marketing to ETF providers:

- Understand the key decision-makers: Marketing content should speak directly to those responsible for selecting benchmarks at ETF issuers. These professionals are looking for clear explanations of how a benchmark can help meet specific goals, such as lower volatility or sustainability-focused strategies. Create messaging that specifically addresses how your benchmarks help ETF providers meet their own clients’ evolving needs, especially in areas like transparency, tax efficiency, and risk management.

- Create case studies: Index providers should develop case studies that highlight the real-world applications of their indexes, showing how they provide value through custom benchmarks or tailored data solutions. These case studies should not only focus on technical success but also address how your benchmarks have helped clients overcome specific challenges, like volatility management or navigating regulatory changes. For example, case studies could focus on how a new volatility index improved a product’s risk-adjusted returns or how a custom ESG index captured specific investor preferences.

- Content formats and channels: Utilizing multi-format content—including webinars, podcasts, and interactive reports—will be essential to engage different audiences. For example, asset managers may benefit from deep-dive reports on the future of direct indexing, while advisors could prefer bite-sized video content that explains how specific benchmarks align with client outcomes. Remember that different audiences consume content in different ways, so ensure that your marketing strategy incorporates both in-depth, analytical pieces and shorter, engaging formats like explainer videos and social media infographics.

Derivatives and direct indexing to engage new audiences

As index providers move into newer areas like derivatives-based ETFs and direct indexing, specific marketing strategies are necessary to educate and engage clients. Direct indexing, for instance, allows investors to build highly personalized portfolios, and index providers must highlight their role in delivering the infrastructure and data tools for this trend. Educational content on how tax-loss harvesting can boost tax efficiency in direct indexing is also useful for clients.

- Educational content for advisors: Advisors may be unsure how direct indexing benefits their clients. Index providers should create content that educates advisors on the advantages of customization and tax efficiency offered by direct indexing, positioning themselves as partners that can help build and support these personalized strategies. In particular, explain how direct indexing can be used to enhance tax management and personalization for high-net-worth clients, providing case examples where it led to improved after-tax performance. Outsourcing investment management through direct indexing can also free up valuable time for advisors, allowing them to focus more on client relationships and business development, such as meetings and prospecting.

- Addressing misconceptions about derivatives-based products: Many investors and advisors still have misconceptions about the complexity and risk involved in derivatives-based ETFs. Index providers can craft content that helps ETF providers simplify these products, using interactive infographics and case studies to demonstrate how derivatives can be used for risk management. Infographics and explainer videos can simplify complex concepts for different client segments.

Marketing as a differentiator in a competitive landscape

To rise above the competition, index providers must continually evolve their marketing efforts. Becoming a thought leader is crucial, and this requires producing content that goes beyond just listing features. Tell stories backed by data, demonstrating how your index solutions help solve real-world problems for clients, from managing volatility to incorporating ESG criteria.

As competition intensifies, the index providers who succeed will be those who actively engage their audience, tailoring marketing strategies to answer critical questions, dispel myths, and showcase their unique capabilities. By addressing key industry challenges head-on, index providers can move beyond being mere benchmark creators to becoming indispensable partners in a rapidly evolving investment landscape.

In a world where content marketing will be a game-changer, those who combine compelling narratives with targeted execution will lead the next wave of passive growth in ETFs, direct indexing, and beyond.

We can help boost index provider content marketing

Wentworth Financial Communications develops content for leading firms across the index and ETF industry, including asset managers representing more than $1.5 trillion in ETF assets. Our clients include several of the largest ETF providers, boutique firms offering cutting-edge ETF strategies, and index providers.

If you would like to chat about how to apply these index provider trends to your marketing strategy, please contact us.

About the Author John Spence leads the ETF content marketing practice at Wentworth Financial Communications. He collaborates with a team of writers and editors at Wentworth to help professionals across the financial services industry build their brands by creating investment-grade infographics, videos, email campaigns, blog posts, social media content, white papers, bylined articles, newsletters, and other forms of content marketing.

About the Author John Spence leads the ETF content marketing practice at Wentworth Financial Communications. He collaborates with a team of writers and editors at Wentworth to help professionals across the financial services industry build their brands by creating investment-grade infographics, videos, email campaigns, blog posts, social media content, white papers, bylined articles, newsletters, and other forms of content marketing.