Financial advisors: How curated content can enhance your content marketing ROI

The rapid shift from in-person meetings to digital communication the past two years has placed a premium on helpful, engaging content that can help financial advisors build deeper relationships with clients.

Creating high-quality thought leadership, however, is simply cost- or time-prohibitive for many advisors. Producing a steady stream of relevant content requires resources, including research, writing, editing, and compliance review. When it’s difficult for even the largest wealth management firms to keep up, the challenge is especially daunting for small, independent advisors.

The good news is that not all the content an advisor sends needs to be created from scratch. Curated content—content that is licensed and passed along from third-party sources—can be a valuable way to augment an advisor’s original content. Using a mix of original content and curated content can help advisors stay in touch with their clients through a steady stream of high-quality insights.

Meet your clients where they are

Karim Rashwan, managing director at AdvisorStream, provided an overview of content curation at a recent Financial Communications Society (FCS) event. AdvisorStream is an advisor marketing platform that combines marketing automation with licensed content curation from trusted publications such as The New York Times, The Wall Street Journal, Bloomberg, and Reuters.

Content marketing has been a traditional blind spot for many advisors because they’re so focused on investment management, financial planning, and client service. AdvisorStream helps advisors have a consistent communication flow to their clients and prospects to position themselves as thought leaders by mixing in independent content, Rashwan explained.

In the past, many firms relied on printed newsletters, live events, and seminars to communicate with their client base. The pandemic, however, has accelerated the shift to digital communications. That means advisors need to be more active in all digital channels with more emails, social media activity, and keeping their websites updated with current and relevant content.

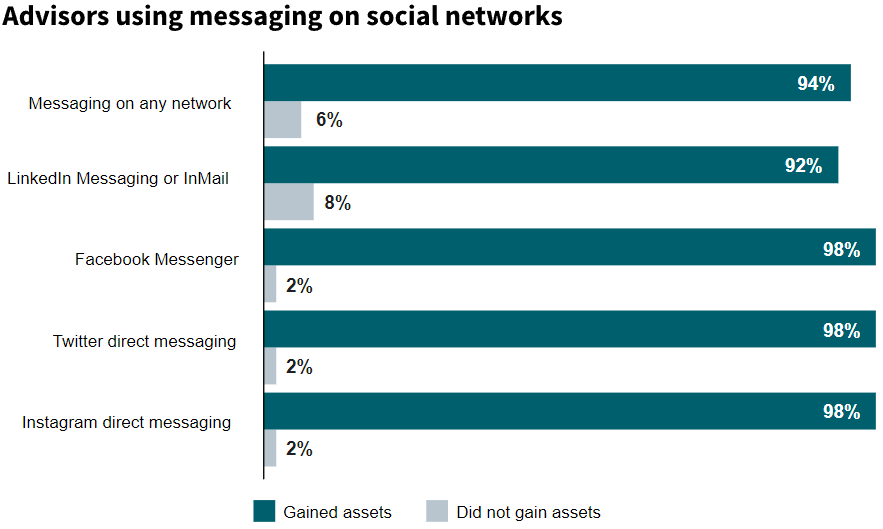

Social media can also be a powerful tool for advisors to distribute content and market themselves if done correctly. During the COVID-19 pandemic, 74% of U.S. financial advisors who used social media for business initiated new relationships or onboarded new clients, according to the Putnam Investments Social Advisor 2020 Study.

Advisors are leveraging social media effectively to engage clients and prospects

Source: Putnam Investments Social Advisor 2020 Study.

Finding the right mix of original and outside content

Clients want to know their advisors’ views on the markets, investment decisions, and wealth management strategy. Communicating these views is a critical part of advisors’ value proposition and a vital way to earn trust. That’s why original content that conveys these views and captures the advisor’s unique voice should always be a cornerstone of your content strategy.

But given the need to provide a consistent stream of content to inform clients and stay top-of-mind with prospects, it’s not possible for advisors to provide original thoughts on all the topics. Having a mix of original and curated content allows advisors to share their views while scaling their content creation efforts.

In addition to these efficiency benefits, licensing content from some of the world’s most trusted publications helps to add depth and perspective, Rashwan said.

An advisor sharing only in-house opinions and content “might be seen as self-serving, for lack of a better term,” he said. Advisors can support their own views “with a third-party message that’s neutral and content that isn’t meant to promote any single firm or push investment products, which can help boost advisors’ credibility and support their message without sounding corporate or self-serving.”

For example, if a firm has an opinion on inflation or volatility, they can back up that view with unbiased, third-party content.

In terms of maximizing ROI with marketing, Rashwan said a mix of 85% licensed content and 15% original content is a model he’s seen work for some advisors, especially those that don’t have the marketing budget to create a lot of original pieces.

Of course, advisors who have more resources and prioritize building a unique brand that connects with clients will likely want to have a mix that is more heavily tilted toward original content. In our view, advisors who prioritize developing a distinct brand and have differentiated investment views see more value in having original content be the cornerstone of their marketing efforts, while using curated content to add scale and fill in the gaps.

The content that clients engage with the most

One common mistake advisors make is focusing all their content on the markets and personal finance. It’s valuable to mix in other topics that help clients learn about how to actually enjoy their hard-won wealth, for example.

“When we look at what resonates with advisors’ clients, personal finance is obviously a big part of that. But what we also find is that the most engaging content tends to come from the lifestyle content that we curate,” Rashwan said. “It can be a little heavy sometimes for clients to be reading just everything to do with finance and the economy.”

In other words, clients need a break from retirement saving, investment management, and estate planning.

In fact, about 25% of AdvisorStream’s content library is focused on topics such as health and wellness, travel and vacation, and food and wine. Those topics tend to generate the most views. Two of the most popular articles that AdvisorStream has curated from The New York Times the past year include The True Cost of Upgrading Your Phone and This Year, Try Spring Cleaning Your Brain.

“For advisors, that balance is really important because over time what we’ve seen is more of an emphasis on advisors having to understand their clients’ overall picture versus just their finances,” Rashwan said.

“They really need to be quite involved in what’s going in their clients’ lives in general and understanding what their clients are consuming in terms of content,” he added. “These are pieces of content advisors are sharing with their clients that are something lighter that can maybe help them later refocus on their finances.”

—

Do you have questions for John Spence or about how Wentworth Financial Communications can help you? Reach out to John at jspence@wentworthwriting.com.

About the Author  John Spence is Director, Marketing and Content Strategy, at Wentworth Financial Communications. He collaborates with a team of writers and editors at Wentworth to help professionals across the financial services industry build their brands by creating investment-grade white papers, bylined articles, newsletters, blogs, social media posts, and other forms of content marketing.

John Spence is Director, Marketing and Content Strategy, at Wentworth Financial Communications. He collaborates with a team of writers and editors at Wentworth to help professionals across the financial services industry build their brands by creating investment-grade white papers, bylined articles, newsletters, blogs, social media posts, and other forms of content marketing.