It’s been 25 years since the first exchange-traded fund (ETF) was launched, enabling investors to buy or sell the S&P 500 Index in a single publicly traded share.

But as the ETF industry continues to grow beyond simple index-tracking products and into more complex asset classes, financial marketers face the task of differentiating themselves within a field of nearly 7,200 products totaling $4.8 trillion in worldwide assets. (To be sure, inflows into mutual funds still tower ETFs. There were $14.7 trillion in U.S. mutual funds at the end of 2017, according to Morningstar, compared with $3.4 trillion in U.S. ETFs.)

Such a challenge is made more difficult by today’s ultra-competitive sales and marketing environment in asset management, where the opportunities for firms to get in front of and sell to financial advisors directly continues to dwindle year-over-year. That has put more onus on asset managements’ marketing departments to think strategically and creatively.

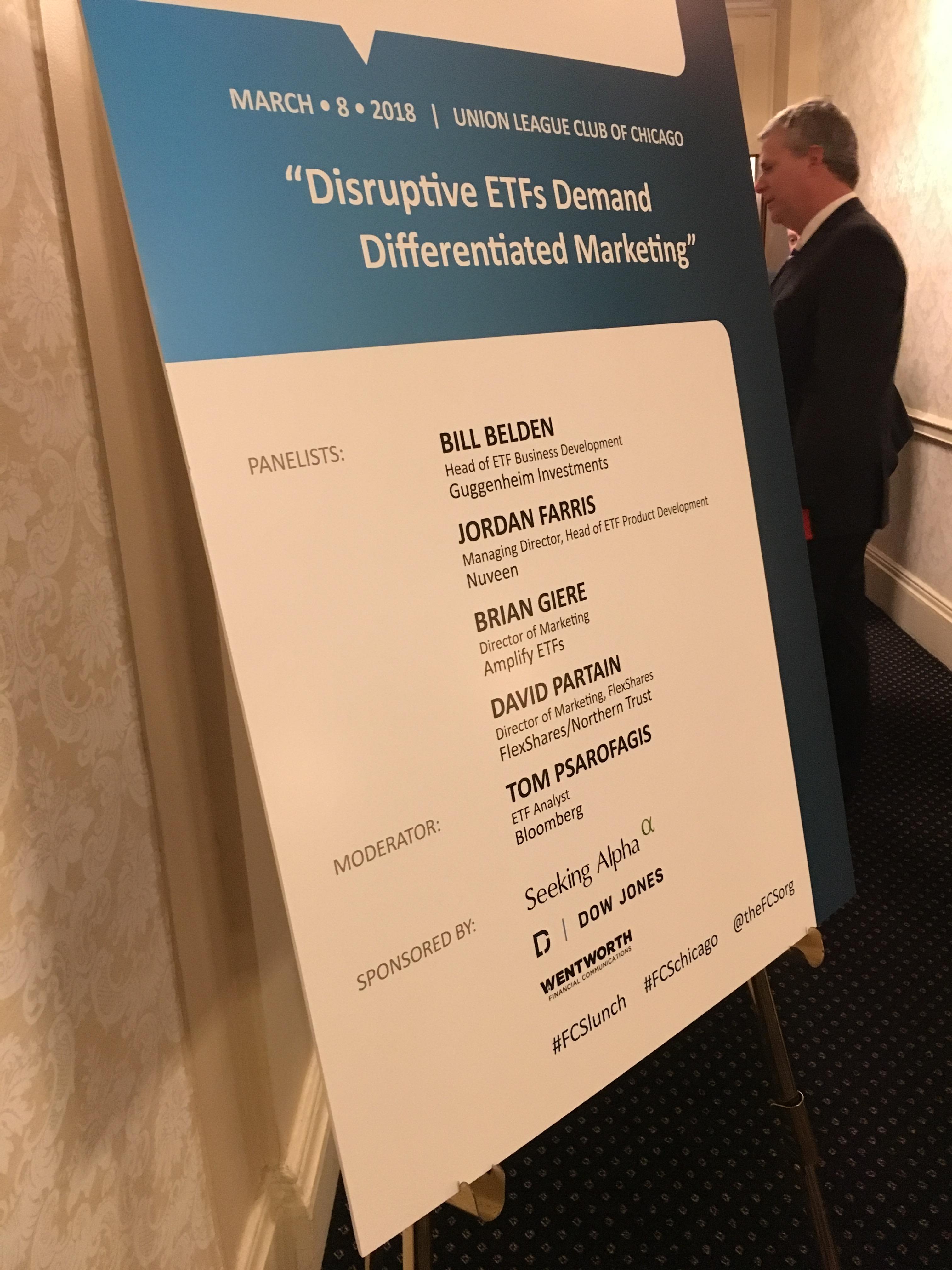

Financial marketers gathered at the Union Club of Chicago on March 8 to peel back the onion on differentiated strategies for the ever-crowded ETF market. The luncheon event, hosted by the Chicago chapter of the Financial Communications Society, featured a panel of marketing and ETF product executives from Chicago-area offices of some of the top asset managers in the ETF business.

“Marketing owns 70% of the [sales] process now,” said David Partain, a panelist at the FCS event and the director of marketing at FlexShares, the ETF unit of Northern Trust, the 129-year-old Chicago-based wealth management firm with just more than $1 trillion in assets under management. “That’s a realization that is starting to hit people.”

The rest of panel included:

- Jordan Ferris, managing direct, ETF product development, Nuveen

- Bill Beldon, head of ETF business development, Guggenheim Investments

- Brian Giere, director of marketing, Amplify ETFs

Anthanasios (Tom) Psarofagis, an ETF analyst with Bloomberg Intelligence, moderated the panel.

Filling the Gap: ETF Education and Marketing’s Growing Importance

One major takeaway from the FCS panel discussion was that, even though ETFs represent a growing share of U.S. asset management inflows, marketers in the industry still have to spend a good amount of their resources educating advisors and investors in their products before they can sell them.

This is especially true as more and more new ETF products come to the market offering exposure to diverse and distinct asset classes.

For instance, even though most advisors and investors are familiar with the concept of an ETF and how it is different from a mutual fund, many of the new niche products now coming to market are more complicated than the simple, index-tracking products that initially made ETFs popular with investors.

“We spend a lot more time than you might think on education,” said Guggengeim Investments’ Beldon, adding that many of the new products sold as ETFs may actually be shares in notes or trusts, not necessarily funds, as the name implies.

As a result, marketers need to be sure to incorporate a large educational component into their messaging and interactions before they put on the hard sell. Moreover, being transparent is especially important as more and more new ETFs come to market with complex investing structures.

Oftentimes, marketing isn’t just tasked with educating financial advisors or other end-users or buyers of ETFs, but are also increasingly looked to by the firm’s sales colleagues to help educate them on the best way to tell a unique ETF product’s story to the market.

“We rely on marketing to guide us through what information needs to be utilized in the salesforce to give us the best chance of making that sale,” said Nuveen’s Ferris.

Nuveen’s business is primarily on the active management side of the investment spectrum. But as the passive side of the house continues to grow at the firm through its ETF portfolio, Ferris said marketing’s role at Nuveen in helping educate its salesforce will likely increase.

Spreading the Word: Using Digital Tools to Manage the Message

In addition to educating advisors and investors—and even internal sales teams—on the expanding world of ETFs, financial marketers in the industry also have to learn to utilize emerging digital media channels to market their products.

Social media, in particular, presents both an opportunity and a challenge for ETF marketers, the panelists concluded, especially as more advisors are relying on such platforms to get their information.

That’s because social platforms present opportunity in the form of being able to quickly and efficiently spread the word about a new ETF product, and a challenge in the fact that financial services firms are limited by having to adhere with compliance standards that are often at odds with the benefits of social media.

“We have to be on there,” said Amplify’s Giere, in reference to social media. “Any firm or influencer has to be on social media to some extent. The difficulty is compliance, of course. You can’t be as nimble and quick as far as your messaging.”

“Compliance is an issue,” added Northern Trust’s Partain. “You cannot be nimble with [social media]—if it’s not days, it’s hours.”

Even though marketers may not be able to react to market-moving events or join certain social conversations with product messaging as nimbly as they’d like, the panelists said there are still ways to use social media despite the industry’s compliance-related restrictions.

For instance, at Northern Trust’s FlexShares, Partain said the firm focuses on establishing pre-planned quarterly themes on social media. That way the firm can still effectively use social media to tell its story while keeping with its compliance standards.

“We also focus around particular campaigns,” Partain said, when talking about how the firm uses social media and other digital platforms. “So we’re taking one piece [of content] and re-using it in multiple ways—either as a different type of video or motion-graphic video, to a white paper or infographic—because you have advisors that fall into the different generations, and all of us are moving to pay attention for no longer than a couple of seconds. So you really have to hit them where they are, because they’re just inundated.”

Is a Ticker a Sticker? Making Each Letter Count

Finally, the panel ended its conversation on somewhat of a lighter note, talking about if an ETF’s ticker played a significant role in its marketing.

By and large, the panelists concluded that the ticker likely does play some role in an ETF’s marketing—although it’s probably not a significant one.

Amplify’s Giere said the firm tries to come up with tickers for its ETFs that are catchy and represent a word, or something a person could say. For example, when Amplify recently launched earlier this year an ETF for companies that invest in the emerging network technology blockchain, it chose to use the ticker BLOK.

Nuveen’s Ferris said the firm takes a different approach to its tickers. While he said there definitely is a marketing component factored in, Nuveen’s tickers are designed more to brand the firm and the specific investment type the ETF represents. For instance, a large-growth equity fund may bear the ticker NULG—Nuveen and large growth.

“We wanted all the tickers to start with ‘NU’ so that the product is memorable,” Ferris said, adding that the firm’s thinking is that if every ticker is consistent with the Nuveen brand that investors will see it as a representation of the firm’s consistency in investing success.

Get Involved with FCS

To learn more about the Financial Communications Society and upcoming FCS events across the country, visit www.thefcs.org or contact Kevin Windorf, CEO of the FCS, at kevin@thefcs.org.

About the Author

Frank Kalman is the chief operations officer at Wentworth Financial Communications. Frank and the team of writers and editors at WFC help professionals across the financial services industry build their brands by creating investment-grade white papers, bylined articles, newsletters, blogs, social media posts, and other forms of content marketing.