Creating thought leadership and other forms of branded content has essentially become table stakes for financial services firms. Today, every brand is a publisher. In this crowded environment, how do you rise above the noise and create content that delivers a positive return on investment (ROI) for your firm?

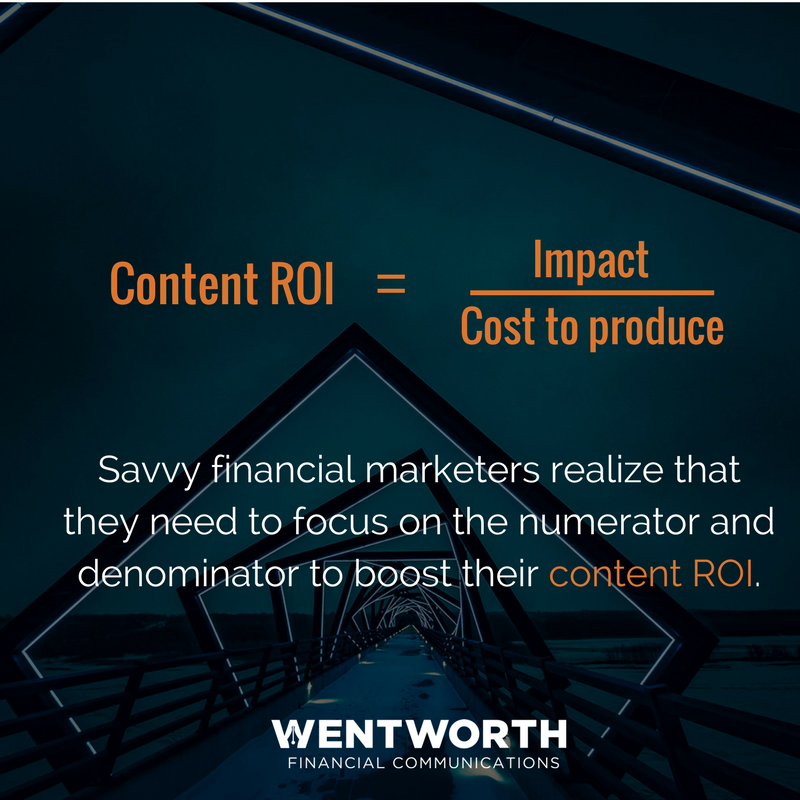

When thinking about your content’s ROI, it’s easy to get bogged down with all sorts of metrics like conversion rate, net promoter score, and audience equivalency. While those metrics definitely serve a purpose, it’s important to remember that ROI, at its core, is a very basic fraction. The numerator is the impact that your content has on your target audience, whether through building brand awareness, driving engagement, or increasing leads. And the denominator is the cost—in terms of time, money, and energy—of creating that content.

When thinking about your content’s ROI, it’s easy to get bogged down with all sorts of metrics like conversion rate, net promoter score, and audience equivalency. While those metrics definitely serve a purpose, it’s important to remember that ROI, at its core, is a very basic fraction. The numerator is the impact that your content has on your target audience, whether through building brand awareness, driving engagement, or increasing leads. And the denominator is the cost—in terms of time, money, and energy—of creating that content.

Anyone who has passed fourth-grade math knows that there are two basic ways to increase the value of any fraction: 1) increase the numerator or 2) decrease the denominator. And with content ROI, it’s no different.

Let’s start by looking at the numerator. Based on our experience at Wentworth Financial Communications working with brands across the asset management, investment banking, and private equity industries, we have identified three primary ways to improve your financial content’s ROI by increasing the impact that it has on your target audience.

Think Like a Journalist

As the line between journalism and marketing continues to blur, financial brands have new opportunities to showcase their expertise by sharing objective, newsworthy information with their target audiences. To do this, financial marketers need to adopt practices that define quality journalism. Specifically, marketers need to 1) cover topics that are relevant to the target audience and 2) be explicit in showing how the information affects the audience.

Too often, financial marketers begin brainstorming content marketing ideas by asking: What do we want to write about? Or, what can we write about that will showcase our expertise? But, unfortunately, readers often don’t care about those things. In a world where your target audience is being inundated with information, the only way you can get people to click on your article or download your white paper is to address topics that matter to your audience.

When determining which topics you should address, start by thinking about a Venn diagram with two circles that overlap. One circle contains things your audience cares about, and the other circle contains things your firm is qualified to comment on. The area where these circles overlap is where all of your content marketing topics should come from.

One of the tenets of journalism is that every article needs to pass the “so what?” test. It’s not enough to just explain what happened, you have to explain the larger context of the events and describe why they matter. Financial marketers need to rigorously apply the “so what?” test to their content, as well.

Don’t just explain what impact rising interest rates will have on bond markets, describe how clients’ portfolios will be affected by rising rates and lay out steps clients can take to position their portfolios appropriately. Don’t just analyze the S&P 500’s current P/E ratios relative to historical norms, describe the forces that have led to the valuation expansion and talk about how clients should be reallocating their portfolios toward sectors, companies, or regions that are less frothy.

Narrow Your Focus

In an over-saturated media landscape, the only way to fill gaps in your audience’s knowledge is by going granular. That is to say, the best way to showcase your specialized expertise is to be very narrow and specific in the types of topics you address in your content. Narrowing the focus of your content allows you to showcase the depth of your expertise and provide valuable insights in a piece that is easy for the audience to digest.

Many firms make the mistake of trying to address overly broad topics in their thought leadership. Financial marketers may think that a piece needs to explain everything there is to know about a topic in order to be viewed as authoritative. But overly broad topics often result in content that is either 1) too long or too dense to keep the audience’s attention, or 2) too high-level to add any value for the audience.

Publishing several shorter, more focused articles is usually more effective than writing one comprehensive piece. For example, rather than writing one white paper about valuation trends in emerging markets, an asset management firm should consider publishing a series of articles that each focus on a specific region. In addition to giving the author space to explore each region in depth, this approach creates recurring touchpoints with the audience.

Have a Distinct Point of View

You can’t be a “thought leader” in the financial services industry unless you are willing to publish original thoughts. You must be willing to take a stance that may be unconventional or unpopular. In fact, to be a thought leader, you need to introduce ideas that others in your field may challenge or try to disprove.

The goal of any thought-leadership program should be to showcase how your firm is thinking about the market environment in ways that your competitors aren’t—and then explain how this unique perspective is creating value for your clients. If you are just repeating conventional wisdom, your content is just adding to the “noise.”

Once you decide on a topic, look for opportunities to advance the conversation by pointing out any common misconceptions about the topic or by explaining how the conventional wisdom has been rendered obsolete by a new market development or tax law.

Decreasing the Denominator

The three best-practices described above all focus on increasing the numerator of the financial content ROI fraction. But there also are things you can do to drive ROI by decreasing the denominator.

About the Author

Scott Wentworth is the founder and head financial writer at Wentworth Financial Communications. Scott and the team of writers and editors at WFC help professionals across the financial services industry build their brands by creating investment-grade white papers, bylined articles, newsletters, blogs, social media posts, and other forms of content marketing.

Scott Wentworth is the founder and head financial writer at Wentworth Financial Communications. Scott and the team of writers and editors at WFC help professionals across the financial services industry build their brands by creating investment-grade white papers, bylined articles, newsletters, blogs, social media posts, and other forms of content marketing.